Mortgage Adviser

Mortgage advice to get you moving

Bad credit, low deposit, or just unsure where to start? Let our mortgage adviser take the stress out of homebuying. Save time, money and find a mortgage that's right for you.

- +2000 reviews

- Rated as excellent

- 4.98/5

Reliable and overall great service! Big thanks to GHL Direct for helping me out with my first property!

Lawrence Siu, reviews.io

Why choose us

You find the home, we find a mortgage

Let out mortgage experts handle the mortgage search, application, and everything in between. Save time, save money, save stress.

Save Time

Don’t waste your valuable time researching mortgage rates and completing lengthy application forms. We’ll take care of it for you.

Save Money

Save money on your mortgage with better rates and lower application fees, it could mean big savings on your monthly payments.

Get Exclusive Rates

Your mortgage adviser has access to 1000’s of mortgage rates and exclusive offers that that may not be available to you directly.

how to get a mortgage

Take the first step

Advice whenever you need it

Expert mortgage advisers available from 8am - 8pm Monday to Friday & 9am - 6:30pm on Saturday & Sunday.

mortgage adviser

Can I get a mortgage

Our experienced mortgage advisers specialize in helping first time buyers like you navigate the home-buying process. We'll help you:

-

Find the right mortgage Discover exclusive mortgage rates and personalized advice tailored to your unique financial situation.

-

Simplify the process Let us handle the paperwork and negotiations, so you can focus on the more exciting things in life.

-

Ensure mortgage affordability: We'll make sure you qualify for a mortgage you can comfortably afford, giving you peace of mind.

first time buyer help

Your mortgage questions

A mortgage adviser is a professional who helps people find the right mortgage deal for their individual circumstances. They can provide advice on various mortgage products, mortgage interest rates, and the application process.

A mortgage adviser, also known as a mortgage broker acts as an intermediary, connecting you with various lenders to find the right mortgage rates. They often have access to a wider range of products than individual lenders.

Many people struggle to secure a mortgage due to factors like poor credit history, insufficient savings, or a lack of understanding about the mortgage application process. These challenges can make it difficult to achieve the dream of buying your first home.

While it's not mandatory, a mortgage adviser can be invaluable in helping you navigate the complex world of mortgages. They can save you time, money, and potentially avoid costly mistakes.

Here are some questions you can ask your mortgage adviser:

- How much can I borrow?

- What type of mortgage is best for me?

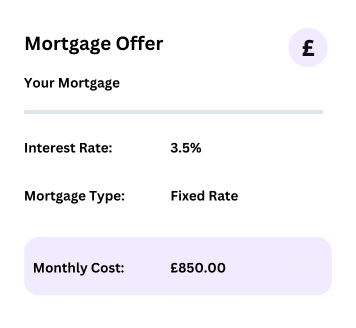

- What are the interest rates and fees?

- What are the monthly repayments?

- What happens if I can’t afford to make my repayments?

- What are the pros and cons of different mortgage products?

Fixed-rate mortgages: With a fixed-rate mortgage, your interest rate will stay the same for the entire term of the mortgage. This can provide peace of mind, as you know exactly what your monthly payments will be. However, if interest rates rise, you will not benefit from the lower rates.

Variable-rate mortgages: With a variable-rate mortgage, your interest rate will fluctuate based on the Bank of England base rate. This means that your monthly payments may go up or down, depending on the market. However, if interest rates fall, you will benefit from the lower rates.

Tracker mortgages: A tracker mortgage is a type of variable-rate mortgage that tracks the Bank of England base rate. This means that your interest rate will always be a certain percentage above the base rate.

Discounted mortgages: A discounted mortgage is a type of variable-rate mortgage that is offered at a discount to the lender’s standard variable rate (SVR). This means that your interest rate will be lower than the SVR, but it may still fluctuate.

First time buyer scheme: Help to Buy: Equity Loan | Shared ownership | The Mortgage Guarantee Scheme

Your first meeting with a GHL Direct mortgage adviser is completely free and doesn't commit you to anything. We'll always clarify any fee structure upfront.

Many mortgage advisers offer their services for free. Their income is typically generated through commission from the lender.

Ready to find a mortgage

Our mortgage advisers get you moving

YOUR HOME OR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. MOST BUY TO LET MORTGAGES ARE NOT REGULATED BY THE FINANCIAL CONDUCT AUTHORITY