ghl direct

The experts in financial advice

Financial advice isn't just for the wealthy. Everyone can benefit from our expertise. Whether you need help with mortgages, insurance, or pensions, we're here to make your life simpler

- Rated as excellent

- 4.98/5

- Chat today

Very helpful, explaining things relating to the mortgage and helped remortgaging be less stressful

Louise Mason, Reviews.io

YOUR HOME OR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. MOST BUY TO LET MORTGAGES ARE NOT REGULATED BY THE FINANCIAL CONDUCT AUTHORITY

hello

We are GHL Direct

GHL Direct provides expert mortgage, protection and wealth advice. GHL Direct is not a business in it's own right, it is a trading name of GHL Network Services Ltd which is an appointed representative of The Openwork Partnership, a trading style of Openwork Limited which is authorised and regulated by the Financial Conduct Authority

Book a call

Our easy online form lets you choose the time and day that works best for you. We're available 7 days a week from 8am to 8pm.

Lets have a chat

And discuss your mortgage needs, including insurance and protection options that might be right for you. No pressure, just a friendly conversation

Application process

We’ll handle all the paperwork and communication, working closely with lenders and providers to ensure your application goes smoothly.

3 simple steps

How to get financial advice

Advice whenever you need it

Get expert financial advice, from 8am - 8pm Monday to Friday & 9am - 6:30pm on Saturday & Sunday.

Get financial advice

Need a helping hand with your finances?

Our friendly team of experts is here to guide you every step of the way. From mortgages and insurance to pensions and investments, we'll help you find the perfect solutions to suit your needs.

No more stress, no more hassle. Book your no obligation consultation today and let's chat about your financial goals. We'll work together to find competitive rates, even ones your bank might not have access to.

It's as easy as 1, 2, 3. Simply book online or give us a call. Let's start building your financial future together.

Expert

Financial services

Book a no obligation consultation with a financial adviser today. Stress free advice from the comfort of your own home.

Find a mortgage

We'll find you a mortgage and handle all the paperwork, saving you time, hassle and money.

Insurance advice

From critical illness cover to life insurance, home insurance to income protection. We've got you covered

Pensions & Investments

Tired of worrying about retirement? Let our expert financial advisers help you plan for a comfortable future

Need financial advice?

Our financial advisers throughout England & Wales are ready to chat today. Book your no obligation chat in just 30 seconds.

still have questions

We have answers

A financial adviser is a professional who provides guidance and advice on financial matters. They can help you with various aspects of your financial life, such as buying a home, insurance and protection,investing and retirement planning

While not everyone needs a financial adviser, they can be particularly helpful if you:

- Have complex financial situations

- Are unsure about your financial goals.

- Want to make informed investment decisions.

- Need help with retirement planning.

Your first meeting with a GHL Direct financial adviser is at no cost to you and doesn't commit you to anything. We'll simply chat about your goals and see how we can help. We will advise you up front on any of the below:

Fees: They may charge a flat fee, hourly rate, or percentage of assets under management.

Commissions: Some advisers may earn commissions on products or services they sell to clients.

Retainer fees: This involves a fixed fee paid upfront for ongoing services.

Here are some questions you can ask your mortgage adviser:

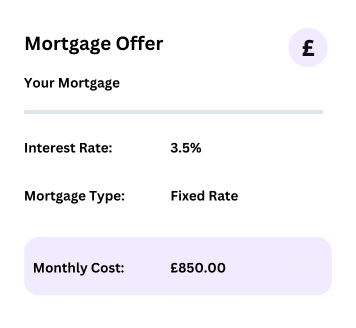

- How much can I borrow?

- What type of mortgage is best for me?

- What are the interest rates and fees?

- What are the monthly repayments?

- What happens if I can’t afford to make my repayments?

- What are the pros and cons of different mortgage products?

A GHL Direct financial adviser can provide a wide range of services, including:

- Mortgage Advice

- Insurance Advice

- Protection Advice

- Financial planning

- Investment management

- Retirement planning

GHL Direct Financial advisers are required to act in their clients best interests. As a starter you should:

- Check external online reviews

- Ensure they are FCA registered

- Understand their fee structure

- Ask to see their policy on treating customers fairly

- Seek out second opinions if necessary