adverse credit mortgages

Looking for a specialist mortgage adviser?

You're in the right place. We specialise in helping people with defaults, CCJs, or low credit scores find mortgage rates that fit their unique circumstances.

- Fee free

- 4.98/5

- Rated as excellent

Why choose us

The specialist mortgage adviser.

Been turned down for a mortgage due to bad credit or you cant find a mortgage with an iva?. We don't think Having bad credit shouldn’t prevent you from applying for a mortgage.

Save Time

Don’t waste your valuable time researching mortgage rates and completing lengthy application forms. We’ll take care of it for you.

Save Money

Save money on your mortgage with better rates and lower application fees, it could mean big savings on your monthly payments.

Get Exclusive Rates

Your mortgage adviser has access to 1000’s of mortgage rates and exclusive offers that that may not be available to you directly.

Couldn’t have asked for better service!

Jamie Radcliffe

client reviews

Real advisers.

Real reviews.

Thousands of people have trusted our specialist mortgage advisers to help them buy a home. Lets see if we can help you too.

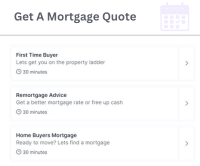

how to get a mortgage

Take the first step

Three simple steps to make your adverse credit mortgage possible - benefit from expert guidance from specialist mortgage advisers here to help you find a mortgage.

Advice whenever you need it

Get expert mortgage advice, from 8am - 8pm Monday to Friday & 9am - 6:30pm on Saturday & Sunday.

poor credit mortgages

Can I get a mortgage

Our specialist mortgage advisers can guide you through the entire process. We'll help you:

-

Find the right mortgage Discover exclusive mortgage rates and personalized advice tailored for those with less than perfect credit.

-

Simplify the process Let us handle the paperwork and negotiations, so you can focus on the more exciting things in life.

-

Ensure mortgage affordability: We'll make sure you qualify for a mortgage you can comfortably afford, giving you peace of mind.

bad credit mortgage help

Your mortgage questions

Adverse credit mortgage brokers are financial professionals who specialize in helping individuals with less-than-perfect credit histories secure home loans. They understand the unique challenges you may face and work diligently to find mortgage options that suit your specific needs

It is possible to get a mortgage with an IVA. However, your options will be limited and the terms of the loan will be less favourable than what you would receive if weren’t in an IVA.

This is because lenders view IVAs as a sign of financial difficulty which therefore makes you a higher risk borrower.

As a specialist mortgage adviser we work with many lenders and will be able to advise on the right solution for your circumstances.

It depends on your specific circumstances. Factors like the severity of your credit issues, your income, and your employment history will all play a role. Checking your credit score and speaking with a specialist mortgage broker from GHL Direct can help you determine your eligibility.

We try to help first-time buyers, people remortgaging, home movers and buy to let landlords apply for a mortgage with bad credit. We know the lenders likely to approve your mortgage application so you can feel confident the lender you select is going to approve your application.

Secured loans: These mortgages require collateral, such as a savings account or a property, to secure the loan.

Mortgage guarantor loans: A guarantor (usually a family member or friend) agrees to be responsible for the loan if you default.

Specialist mortgage lenders: These lenders specialize in providing mortgages to individuals with adverse credit.

Yes, you can get a mortgage if you're self-employed but process might be slightly different compared to someone with a traditional job.

Mortgage lenders will typically require more financial information to assess your income stability, such as:

Tax returns: At least two years' worth of self-assessment tax returns (SA302 forms).

Accounts: Certified accounts for the same period.

Bank statements: Evidence of your income and spending patterns.

Here are some questions you can ask your mortgage adviser:

- How much can I borrow?

- What type of mortgage is best for me?

- What are the interest rates and fees?

- What are the monthly repayments?

- What happens if I can’t afford to make my repayments?

- What are the pros and cons of different mortgage products?

Fixed-rate mortgages: With a fixed-rate mortgage, your interest rate will stay the same for the entire term of the mortgage. This can provide peace of mind, as you know exactly what your monthly payments will be. However, if interest rates rise, you will not benefit from the lower rates.

Variable-rate mortgages: With a variable-rate mortgage, your interest rate will fluctuate based on the Bank of England base rate. This means that your monthly payments may go up or down, depending on the market. However, if interest rates fall, you will benefit from the lower rates.

Tracker mortgages: A tracker mortgage is a type of variable-rate mortgage that tracks the Bank of England base rate. This means that your interest rate will always be a certain percentage above the base rate.

Discounted mortgages: A discounted mortgage is a type of variable-rate mortgage that is offered at a discount to the lender’s standard variable rate (SVR). This means that your interest rate will be lower than the SVR, but it may still fluctuate.

First time buyer scheme: Help to Buy: Equity Loan | Shared ownership | The Mortgage Guarantee Scheme

Your first meeting with a GHL Direct mortgage adviser is completely free and doesn't commit you to anything. We'll chat about your mortgage goals and see how we can help.

Just to be upfront, our mortgage advisers might charge a fee based on how complicated your situation is. Some mortgage brokers charge a one-time fee, while others earn a commission from the lender. Your adviser will explain everything clearly before we start

Ready to find a mortgage

Our mortgage brokers know how to get a mortgage, so sit back and let us take the stress out of buying a home with bad credit.

YOUR HOME OR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.